Everything on CI/CD for FinTech

The world of FinTech is rapidly evolving with large-scale investments and the creation of new ideas in the field. The change is constant, and so are the expectations for new services, modifications to existing ones, and faster release cycles. The need for speed is a given in the FinTech industry.

The competition is fierce, and the pressure is on companies to get products to market quickly before their competitors. With continuous integration and continuous delivery and deployment (CI/CD), organisations can achieve all of the above, resulting in a drastic increase in quality and speed to market.

Gitlab found that while CI/CD helps teams move more quickly and accomplish more, it frees up time for both developers and their operations counterparts. Thanks to the automation made possible by continuous integration and deployment, the amount of work that must be done by hand to create software has been dramatically decreased.

Unfortunately, these tools are not widely adopted by the FinTech sector. Various surveys have shown that while CI/CD is becoming increasingly popular in enterprise IT, its utilisation is still far from universal. Only 38% of the 3,650 respondents in Gitlab’s 2020 poll, “Mapping the DevSecOps Landscape,” reported using CI/CD as part of their DevOps workflows.

Meanwhile, a 2019 study of 130 developers conducted by Codefresh found that 32% were not utilising any CI/CD technologies, while about 60% claimed their firms were not leveraging enough automation to affect the rate of software delivery.

The lack of knowledge about CI/CD and its benefits contributes significantly to this gap. Therefore, this article aims to provide decision-makers and developers working in the FinTech sector with a better understanding of what CI/CD is and how they can use it in development processes.

What is CI/CD?

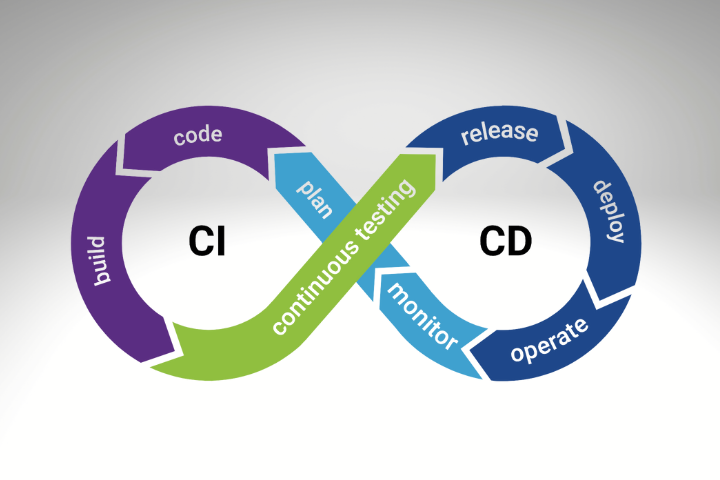

CI/CD is the application of the principles of continuous integration and continuous delivery/deployment to automate DevOps workflows.

Continuous integration (CI) is a practice in software development in which all code developers have written for a project is compiled and run through an automated testing tool every time anyone developer changes the codebase. The main goal of CI is to identify potential problems early on in the development process before those problems impact end users.

Continuous delivery (CD) is based on CI but takes things a step further with even more automation to deliver a packaged piece of code into production at any time as soon as it’s tested. In addition, CD adds the concept of continuous deployment, which refers to automating the entire process from code development through delivery and deployment.

Features of a Good CI/CD Pipeline

- Speed: The goal of a CI/CD pipeline should be to deliver software updates promptly. Each step in the process should have a set time limit that is adhered to and never exceeded.

- Consistency: A CI/CD pipeline should be uniform across all of the pipelines that are deployed. The steps and time limits should always remain the same so that they can be repeated in the future.

- Security Throughout: The product’s security should be a concern from beginning to end in the CI/CD process. One should carefully consider all the steps and migrate any potential security risks.

- Integrated Feedback Loops: A qualitative pipeline will have feedback loops. It will allow organizations to identify any problems or security flaws early on and take the necessary steps to fix them.

Challenges That CI/CD Solves in the FinTech Industry

- Doubts about the quality of the product: The product needed to be tested thoroughly at the outset, or perhaps it was, but now and then, a new bug appears, posing an entirely new set of problems.

- Integration: Making changes to the application’s source code often requires complicated changes to existing applications, as well as heavy integration work between the development team, product management, and operations.

- Manual Process: Most tasks were completed manually before the advent of CI/CD. When one performs manual testing, it can take many days. Delays in getting the product to market are a direct result of this. In addition, teams working on the product are only aware of the existence of the other doers once the product enters mass production.

- Response: In the absence of CI/CD, developers were left in the dark and faced enormous challenges. The development team had trouble isolating the source of the problem. Rarely were problems addressed, and when they were, it was usually from scratch because no versioning systems existed.

Benefits of CI/CD in the FinTech Industry

The use of CI/CD platforms has dramatically impacted the development of FinTech products, from speeding up the build process to improving the overall quality of code. Here are a few ways that implementing CI/CD has positively impacted companies operating in the FinTech sector.

- Quick Launch of New Features: The increased visibility into the product’s development has led to the development of new features more quickly. In case of any problems, you have a one-action rollback at your service.

- Flexibility: In the past, systems were built for specific needs and often consisted of many single-functional applications. With CI/CD, developers can create modular code easily integrated with other databases and applications – a significant benefit for FinTech companies that deal with various technologies.

- Higher Final Quality: A technology that allows testing throughout the software development lifecycle greatly improves the FinTech product’s quality. As a result, features get tested earlier, and bugs can be sorted out early in the development process.

CI/CD Challenges

Although CI/CD proves to be a reliable method for increasing productivity and quality, there are some challenges businesses can face – so it’s better to be safe than sorry.

- The Lack of Professionals: CI/CD requires extensive knowledge of processes and features. Finding the right people with a high level of expertise can take time and effort, especially in smaller businesses.

- Big Upfront Investments: Organizations should implement CI/CD in their product and train their employees to use the technology. A company’s last need is late product delivery, which can certainly happen if it lacks the proper skills.

- Hard To Maintain: More than simply deploying CI/CD methods, they need ongoing maintenance. For large and multifaceted financial institutions, evaluating throughput and cycle times can be challenging.

Speaking of the disadvantages CI/CD may have, in reality, there’s only one – CI/CD pipelines don’t prevent developers from making manual deploys.

Tips To Build CI/CD Right

How can organizations in the financial sector improve the security of their CI/CD processes? What can they do to mitigate risk and ensure data integrity? Here are a few tips to keep in mind.

- Ensure Everyone Knows What to Do: When it comes to CI/CD, everyone needs to realise the potential risk and take the appropriate steps to minimise it.

- Reduce Your Attack Surface: Take the time to identify your infrastructure’s weak points and ensure that they are reflected in your CI/CD strategy. FinTech customers and other financial industry organizations should be able to access their applications anytime, and any potential vulnerabilities should be found and dealt with.

- Practice Threat Modelling: Threat modelling is essential to any security strategy. It involves identifying, prioritizing, and remediating all potential threats to your CI/CD pipelines. Performing this analysis in the front end of your development cycle will allow you time to remediate.

Conclusion

CI/CD is a powerful tool to help any sector, whether educational or FinTech. CI/CD is a must-have in any organization trying to deliver quality software and services quickly and smoothly.

The ability to integrate the pipeline with other systems, test it thoroughly, and deploy it on time allows financial companies to maintain their competitive edge while maximizing application uptime.

Understanding how CI/CD fits your overall business growth strategy is essential, and our team is ready to help you see the big picture.